H I G H L I G H T S

• NEW CHINA DEBT STORY

• GUINEA GAMBIT

• COBALT IN THE CONGO

• KENYA’S TRAIN OF DEBT

• GHANA AND OTHERS

• LESSONS FROM INDIA

NEW CHINA DEBT STORY

China is changing how it provides finance to African governments with a shift to smaller, more targeted loans and grants. State-backed financial institutions like the Export Import Bank of China and the overseas investment insurance agency Sinosure are more choosy about extending credit. One consequence: European export finance agencies have seen an increase in requests for finance for Chinese infrastructure projects.

A September report by the China Africa Business Council, while forecasting China would become Africa’s largest bilateral investor by 2024, cited a number of forthcoming challenges. One, the desire of African governments to diversify their economic relations and move more manufacturing back home, both of which impact China. Two, it urged Chinese firms to avoid controversy by adopting standards like those of the African Union’s Accelerated Industrial Development for Africa and African Mining Vision, as well as environmental standards. Chinese firms are also urged to refocus on renewable energy and look to private sector finance.

Chinese agencies like its Exim Bank are increasingly reluctant to extend credit to countries or projects showing signs of economic distress. The bank recently baulked at providing additional credit to Kenya, citing its problems in repaying earlier loans. Even large state-owned Chinese firms now prefer small and specific loans. For example, the giant construction firm China Three Gorges Corporation signed a tiny $ 31 million substation deal with Ghana.

Chinese companies are increasingly turning to European banks and export credit agencies to finance trade and finance in Africa. Chinese banks are reluctant lenders because of expected restructuring negotiations at home. Quantitative easing also means foreign interest rates are lower. Sinosure has cited limits on country exposure but the evidence suggests this is largely confined to Africa.

Export credit agencies approached by Chinese contractors include Germany’s KfW Ipex-Bank, Sweden’s EKN and UK Export Finance with some success. This is a sea-change for China which rarely approached foreign agencies for financial assistance. Since such agencies have strict criteria, including universal tenders for subcontracts and supplies, this may yet prove too difficult for Chinese firms.

Marie Aglert, director and head of department for large corporates at EKN, says there have been approaches from two international banks to support Chinese construction projects in Nigeria and Tanzania.“According to them, they turned to us because the African countries [which are hosting the projects] are not interested in Chinese financing,” he said.

http://go.pardot.com/e/827843/african-countries-further-debt/yw58v/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/s-african-nations-risk-missing/yw58x/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/-turn-to-europe-for-financing-/yw58z/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/nt-finance-strategy-in-africa-/yw592/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

GUINEA GAMBIT

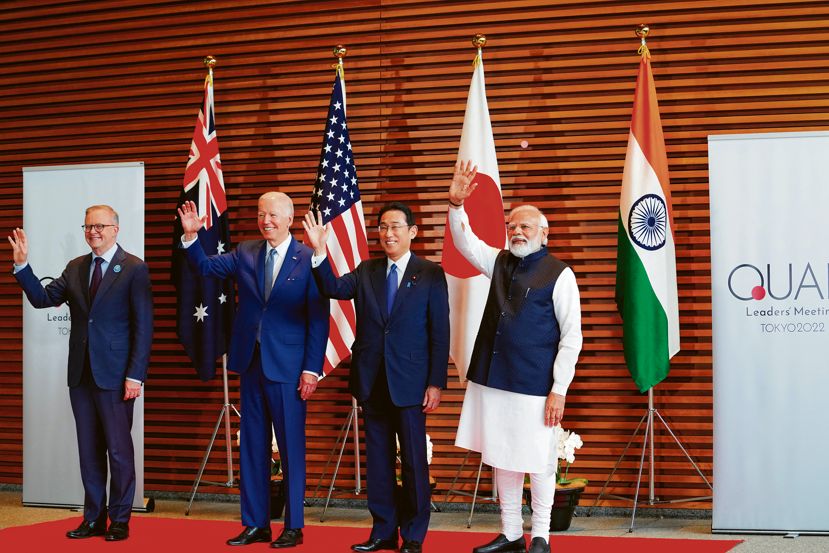

China, which adheres to a non-intervention policy, unusually condemned the September 5 coup d’etat in Guinea. There is a reason. The Francophone state, among the poorest in West Africa, is emerging as one of China’s most important mineral hubs. It is already the single largest source of bauxite for China’s aluminium sector. More recently, Beijing has revived plans to mine eastern Guinea’s iron ore deposits, the largest untapped high-quality ore reserves in the world. A key driver has been geopolitical tensions with Australia, traditionally China’s largest source of iron ore imports.

The 110 km long Simandou hills of Guinea hold an estimated 2.4 billion tonnes of iron ore of 65.5% purity. Conakry’s estimates say 8 billion tonnes. However, high development costs and political uncertainty mean no one has been able to develop the area. A number of analyses say Simandou has now become “the top focus” of China’s attempts to diversify away from Australian iron ore. Beijing has given itself a four-year deadline to begin mining operations. This would include building a 650 km-long railway line across Guinea and a new port. Estimates say the mines could produce a steady 150-million tonnes of ore annually, equal to seven per cent of today’s global exports, and make Guinea one of the three largest iron ore exporters. “They are very serious,” says Peter O’Connor, mining analyst at Australian investment firm Shaw and Partners.

Chinese firms analysts say the project’s high cost would be more than compensated by the savings incurred by pushing down the price trajectory of iron ore. China presently imports just over one billion tonnes of iron ore a year. Some estimates say Simandou’s production would force down iron price’s over time by as much as $ 100 a tonne. If the mine was on line today, this would amount to a savings of $ 100 billion a year for China’s steel sector.

The last Guinean president, Alpha Conde, had been a darling of Beijing. Guinea was among the first countries to receive emergency shipments of Chinese Covid vaccines. Hence Beijing’s shock when, after Conde was re-elected for a third and constitutionally illegal term, the Guinean military overthrew him.

But the Simandou reserves, discovered in the 1990s, have been nightmarishly difficult to tap. Ownership has changed hands several times, billions of dollars spent, but no iron ore has yet to be extracted. At present, Simandou consists of four mining blocks. Two northern blocks are owned by SMB-Winning, a consortium of Singaporean and Chinese companies. The two southern blocks are controlled by Simfer, a firm largely owned by the Australian mining firm, Rio Tinto, and 39.5% by a group of Chinese investors led by Aluminium Corporation of China (Chinalco). The Guinean government holds a 15% in each block.

In May, China Baowu Group, the country’s largest steel refiner, put together a consortium to break the Simandou jinx. The consortium is trying to set up a $6 billion investment fund for the project. Baowu’s proposes to invest $4.5 billion in the southern blocks and $1.5 billion in the northern blocks. Chinese steel-makers would put up half the money and 25% from a Chinese sovereign wealth fund.

Guinea already provides 50% of all of China’s imported bauxite. The coup d’etat saw global aluminium trading prices spike to their highest levels in 13 years before coup leaders made it clear exports would not be affected. China is the world’s largest aluminium producer and consumer. Fourteen Chinese aluminium/bauxite firms operate in Guinea.

The junta has indicated it plans to hold elections and its own members would not be allowed to run for office. A transitional government, headed by the coupster Mamady Doumbouya, has sought to reassure foreign investors, including China, that nothing has changed on the economic front.

http://go.pardot.com/e/827843/-iron-ore-field-101596543-html/yw594/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/-Africa-as-Australia-goes-Quad/yw596/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/ediate-release-of-alpha-conde-/yw598/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/ations-alpha-conde-xi-jinping-/yw59b/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/page-202109-1233515-shtml/yw59d/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/al-local-elections-2021-09-27-/yw59g/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/ots-chinas-belt-and-road-plans/yw59j/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

COBALT IN THE CONGO

The Democratic Republic of the Congo has begun a review of a long-standing mineral-for-infrastructure agreement signed with China. President Felix Tshisekedi has been signalling his displeasure with the activities of Chinese mining firms in his country for several months. The review is expected to pressure Beijing to follow through on its infrastructure promises. Beijing is unlikely to see its control of the country’s cobalt or copper reserves endangered. Congo is the world’s largest producer of cobalt, a mineral essential to green-friendly battery technology. Global demand for cobalt is expected to nearly double to 225,000 tonnes between now and 2025.

The original agreement was signed in 2008 when the Congo, coming out of a civil war, was desperate for funds. China had then promised $ 3.2 billion investment in copper and cobalt mines as well as an additional $ 3 billion in infrastructure. Today, while mining project Sicomines, has received three-fourths of its promised investment, only $ 825 million of the funds promised for infrastructure have been disbursed.

In September, Kinshasa suspended the operations of six Chinese mining firms for illegal activities and environmental damage. The Chinese foreign ministry supported the action, ordering the firms to “respect the order of the local government” and leave the Congo. There had also been public anger over social media videos of Congolese workers being beaten at the orders of Chinese overseers.

The original deal has been renegotiated several times, including a scaling back of the original cost from $ 9 billion to $ 6 billion after a review by the International Monetary Fund. Finance Minister Nicolas Kazadi said the government was concerned at the interest rates being charged, the nature of the mining technical data and the “general management” of the projects.

http://go.pardot.com/e/827843/-criticism-grows-sref-N6C6cytb/yw59l/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/e-investors-finmin-2021-08-27-/yw59n/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/akes-showdown-in-the-dr-congo-/yw59q/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

KENYA’S TRAIN OF DEBT

When Kenya and China announced a $4.7 billion Standard Gauge Railway project, linking the Indian Ocean port of Mombasa to the Ugandan border, it was touted as a project that would transform the economy, creating thousands of jobs and connecting hinterland and coast. Ten years later, only half the project is done. Even while funds to complete the task have dried up, China has demanded payments begin on the debt already incurred. With President Uhuru Kenyatta set to leave office next year, activists have filed cases demanding the government disclose details of the first $3.2 billion contract, something Attorney General Kihara Kariuki has resisted.

China’s Eximbank funded the Mombasa-Nairobi leg of the rail project and the extension to the interior town of Naivasha for a total of $ 4.7 billion. However, in 2018 it demanded a feasibility study for the third leg, which would have gone to the Malaba border crossing with Uganda. It also declined funding for the Ugandan side of the line. Both countries are now reviving an older meter-gauge track between the two countries.

The debt and repayment problems many African governments face following the Covid pandemic has only accelerated a growing Chinese tendency to become more careful about lending. Benjamin Barton of the University of Nottingham’s Malaysia campus, said there also seemed a priority for projects in Southeast Asia. Wu Peng, director general of the Chinese foreign ministry’s department of African affairs, said in an interview that due to the global recession, “the investment and financial support for large-scale infrastructure projects in Africa have become more cautious from both sides: the Chinese and African sides.”

http://go.pardot.com/e/827843/-didnt-end-well-the-last-time-/yw59s/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/ng-into-an-economic-nightmare-/yw59v/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/de-its-chinese-loan-contracts-/yw59x/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/modern-regional-trains-senegal/yw59z/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

GHANA AND OTHERS

Covid and financial caution has also put a $2 billion bauxite for infrastructure deal between China and Ghana on hold for three years. The original Master Project Support Agreement with the Chinese state-owned firm Sinohydro was signed in September 2018. Under the agreement, the Chinese firm was to build infrastructure all across the country, including power lines and new court buildings, in return for access to bauxite reserves. Accra has brushed aside opposition criticism that in the past three years no infrastructure has been built and only $ 100 million of the promised funding has arrived.

The surprise August electoral victory of Hakainde Hichilema in presidential polls in Zambia has put the spotlight on the extent of the country’s debt to China. The outgoing government had been close to Beijing but had insisted external debt to Chinese financiers was not more than $ 3.4 billion. President Hichilema said, “ Now that we’re in, we are beginning to see that the debt numbers that were being talked about officially are not really the comprehensive numbers.” The China Africa Research Initiative of Johns Hopkins University, using its own debt tracker, estimates the actual debt is $6.6 billion, almost equal to a third of the country’s GDP. By 2019, Zambia’s debt to all Chinese lenders was equal to 41% of the country’s gross national income, four times the average of other African countries. The paper argues this was partly a consequence of the unusually high number of Chinese players in the country, both private and state-owned.

One country is still actively wooing Chinese mining interests is Botswana. Botswana hopes to get the Chinese to mine an existing 200 billion tonne coal reserve. The coal is shallow and easily mined but needs a rail link to South Africa. Botswana is in a hurry because it fears that climate concerns will kill any chance of earning the $ 10 billion locked up in the the deposit.

http://go.pardot.com/e/827843/t-one-road-has-been-built-yet-/yw5b2/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/mbiaChineseDebtPandemicEra-pdf/yw5b4/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/nity-to-reset-ties-with-china-/yw5b6/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

http://go.pardot.com/e/827843/un-coal-projects-sref-N6C6cytb/yw5b8/336077027?h=Zjq0HQi1Q0yzTSGGA7dHdlbyHXPoODLUpQVf4fHq2CU

LESSONS FROM INDIA

An article by the Chinese analyst Zhang Xiong, translated by the Eric Orlander of the China Africa Project, on what Chinese firms in Africa can learn from their Indian pharmaceutical counterparts draws three main conclusions. One, they need to focus more on Francophone Africa, traditionally neglected by all Asian firms. Two, Chinese firms need to develop better and more recognizable branding among Africans. Finally, and curiously, it urges companies to hire Indian managers to run their businesses in the continent.