Privatisation gets a boost, but a few areas of concern

The Narendra Modi government has now sent out signals that it is not averse to the idea of privatisation in a few select cases. On November 20, the Union Cabinet Committee on Economic Affairs took three important decisions. One, it approved privatisation of three state-controlled companies. The three companies, which would be privatised or whose management control would move to a new entity, are Bharat Petroleum Corporation Limited (BPCL), Shipping Corporation and Container Corporation of India or Concor. Two, the CCEA decided that the government would completely divest its shares in two other public sector entities – Tehri Hydro Development Corporation and North Eastern Electric Power Corporation. These shares would be sold to another central government undertaking – NTPC. Three, the CCEA gave in-principle clearance to a proposal envisaging that the government can reduce its stake in select public sector units to 51 on a case-by-case basis, while retaining management control.

This was a turning point as far as the Modi government’s approach to public sector undertakings (PSU) is concerned. During the first three years of the first term of the Modi government – between 2014 and 2017, there was no clarity on privatisation. The government’s approach to the idea of exiting PSUs was at best ambivalent. There would be disinvestment or sale of minority shareholdings in PSUs in plenty, but no strategic sale to give up the government’s management or ownership control over them. The finance ministry would set a target for raising resources through strategic disinvestment, which suggested privatisation, but no such action was taken. Only in the last two years of the first term of the Modi government did one see some move towards privatisation. A decision on privatising Air India and IDBI Bank, both financially basket cases and running huge losses, was taken. But soon the decision on IDBI Bank was virtually reversed as it was acquired by another state-owned entity, Life Insurance Corporation of India, and the proposal on Air India was put on the back burner. After Mr Modi returned to power in 2019, the privatisation plan for Air India was revived. And now comes the privatisation plan for three more PSUs.

Of course, the trigger for the privatisation drive is not just the Modi government’s decision to embrace the idea of public sector reform, but also the pressing need for raising more revenue to bridge the fiscal deficit that is threatening to exceed the Budget target of 3.3 per cent of gross domestic product (GDP) for 2019-20. The government has to raise Rs 1.05 lakh crore from disinvestment of government equity in PSUs in the current year. But so far just about Rs 12,000 crore have been raised through this route. In the backdrop of slowing tax collections (they grew by just 1.5 per cent in the first half of the current year), the privatisation drive would not only meet its disinvestment target kept for the year, but also help meet a part of the tax revenue shortfall.

Yet, the government has not completely ignored the political requirements even while going in for privatisation in a big way. The outright sale of BPCL could have also meant the sale of Numaligarh Refinery, the former’s subsidiary created as part of a political accord in 1985 between the Centre and the agitators in Assam, who had desired that there should be an Assam-based refinery to process the crude oil explored and produced in the state. Thus, the Modi government has hived off Numaligarh Refinery from BPCL and assured the Assam government, also ruled by the Bharatiya Janata Party (BJP), that it would continue to exist as a state-owned refinery. In the process, the value that the government would have realised from the sale of BPCL would come down by a few thousand crores, but then that is the cost of political management of privatisation.

Similarly, the move to exit Tehri Hydro Development and North Eastern Electric Power shows how the Union government continues to use the resources of its other profit-making PSUs to meet its fiscal deficit. Last year, India’s largest state-controlled producer of crude oil, ONGC, was told to acquire the government’s shares in HPCL, an oil marketing company, even though the former had to borrow from the market to complete the transaction. Essentially this meant that the government rode on ONGC to book a significant chunk of disinvestment revenue, even though there was no effective change in the nature of HPCL’s management. HPCL continued to remain a PSU and as a subsidiary of ONGC. The government’s decision to sell its shares in Tehri Hydro Development and North Eastern Electric Power to NTPC achieves a similar purpose.

Equally important is to note that the CCEA decided to bring down the government’s equity in a host of other PSUs, on a case-by-case basis and only up to 51 per cent. In other words, these companies would be used only for disinvestment to meet the government’s revenue needs, but without losing management control.

A bail-out for telecom firms is not a sustainable fix

Alarm bells had begun ringing for two of India’s top telecom service providers when they announced on November 14 their financial results for the July-September 2019 quarter. Vodafone Idea posted a loss of Rs 51,000 crore and Airtel’s quarterly loss was over Rs 23,000 crore. The losses were the results of an unprecedented tariff war among the top telecom players, triggered largely by the latest entrant in the field – Reliance Jio. The situation had already become unsustainable when the Supreme Court ordered on October 24 that all the telecom firms, including Vodafone Idea and Airtel, would have to cough up an estimated Rs 92,000 crore by way of past dues to the government. The apex court’s verdict defined what should constitute the telecom firms’ adjusted gross revenues, on the basis of which they would have to pay up spectrum fees to the government. Vodafone representatives talked about the serious questions such developments had raised about the company’s continued operation as a going concern.

Soon after the record quarterly losses announced by the two telecom service providers, Finance Minister Nirmala Sitharaman assured them that the government would not like any telecom companies to shut down. Within days later, the government announced a moratorium on the payment of spectrum dues to the government for two years – a move that would benefit the three top telecom companies by about Rs 42,000 crore.

But larger questions remain. A bail-out is only a bail-out. The financially beleaguered telecom service providers have to fix the weaknesses in their operational performance. By deciding to raise tariffs, they have taken the first big step. But a moratorium on the payment of spectrum dues is only a postponement of meeting a financial liability, not a waiver. It is a responsibility that has only been kicked down the road, to be fulfilled along with some interest payment. Also, the telecom companies have no respite from paying up the spectrum dues of Rs 92,000 crore following the Supreme Court order. The larger issue staring the telecom sector is to make their financial operations viable and ensure that the regulator does not play favourites.

Labour reforms by stealth

After considerable hesitation, the government has given the green signal to another round of labour reforms. In earlier rounds, several pieces of legislation were merged into a simplified labour code on occupational safety, health and working conditions. Another labour code that was passed recently was on wages. The labour code on industrial relations is the third code that has now been given the go ahead so that the legislation can be passed by parliament. On the face of it, the approved code may appear to be a compromise with entrenched trade union interests. But dig a deeper into it, there are some redeeming features as well.

Yes, there is no relaxation in the workforce threshold level above which retrenchment cannot take place without specific approvals from the government. Nor has the retrenchment compensation amount been raised substantially to make the costs of firing staff a little prohibitive so that employers go in for such drastic measures only when it is essential and when it is inevitable and such a measure results in the retrenched employees getting a decent compensation package.

However, in order to protect the relaxation in the retrenchment norms introduced by about half a dozen states already, the new labour code will allow notifications to be issued under the broad legislation to allow enterprises with more than 100 employees to go in for retrenchment without any approvals. This may well be thin end of the wedge of further labour reforms. What this implies is that any other state or even the Centre can notify the relaxed retrenchment rules without seeking Parliament’s approval. Also, the new labour code will provide the legislative backing to enterprises in all sectors to hire employees on contract as long as their statutory dues are protected.

Questions will still being asked on why the Modi government has been so defensive about labour reforms in spite of having got a thumping majority after the general elections in 2019. Easier rules on hire and fire with generous compensation packages for retrenched employees through a legislative change would have sent out a far more reassuring signal, rather than the message of reforms by stealth that the new labour code on industrial relations may convey.

Auto sales revival no comfort as core sector languishes

High-frequency economic data in November provided a mixed picture on the state of the Indian economy. Retail sales of passenger vehicles improved smartly by about 14 per cent in October, compared to the same month of 2018. Two-wheeler sales too recorded a 9 per cent increase in October. These data were obtained from the country’s centralised vehicle registration portal. They brought in a whiff of fresh air, reviving hopes of a demand revival of sorts. The retail sales data came in after reports of passenger vehicle despatches by manufacturers to the distributors showed a decline in October, for the twelfth consecutive month. The divergent trends in retail sales and wholesale despatches indicated that the inventory at the dealers’ end was on the decline and its positive impact on production could be seen soon. Such a positive outlook, however, was missing as far as the commercial vehicles segment was concerned, where retail sales continued to decline in October by over 23 per cent.

No such green shoots of recovery were visible in the electricity sector. In October, the electricity demand in the whole country fell by 13 per cent to 98 billion units, compared to 113 billion units in the same period in 2018. The fall was attributed to a late revival of the monsoon rains, depressing electricity demand. But of greater concern was the fact that October recorded a slowdown in demand for electricity for the third consecutive month. Adding fuel to fire was freight movement by the Indian Railways. Freight loading by India’s largest transporter of goods dropped by 8 per cent in October, the biggest fall in the last nine years and in spite of the Railways’ decision to scrap the 15 per cent busy-season surcharge usually imposed during this period of the year. Even the Reserve Bank of India’s data on bank credit showed that its growth had slowed to 2.7 per cent in September, which was the lowest level of increase in the last one year. Clearly, retails sales of passenger sales may have picked up, but the Indian economy’s core sector woes are far from over and bank credit slowdown is yet to be reversed.

No respite from growth uncertainty

Not surprisingly, industrial growth in September contracted by 4.3 per cent, the worst performance since April 2012. Within the industrial sector, manufacturing declined by 4 per cent and the capital goods sector saw a huge contraction by over 20 per cent. Consumer durables fell by about 10 per cent and even consumer non-durables sector saw contraction. This cast a shadow on the expectations of India’s economic growth in the second quarter. Many economists have forecast that the growth rate for July-September 2019 would range between 4.2 per cent and 4.7 per cent, down from 5 per cent in the previous quarter. The Mid-year Economic Review, undertaken by economists at the National Council of Applied Economic Research and the National Institute of Public Finance and Policy forecast the second-quarter growth of India’s gross domestic product (GDP) at 4.9 per cent. Even for the full year, the Review projected a growth rate of 4.9 per cent. The suspense will be over on November 29, when the government releases the July-September 2019 GDP growth data.

Retail inflation, on the other hand, rose to 4.6 per cent for October, a 16-month high. Retail food inflation rose even higher to 7.9 per cent, the highest level reached in 39 months. Retail inflation, based on the movement in the consumer price index, is now ruling in the upper band of the inflation rate mandated by the Reserve Bank of India. With lower growth and higher inflation, it remains to be seen how the Monetary Policy Committee of the RBI would frame its monetary policy stance at its meeting in the first week of December. It has cut repo rate by over 135 basis points over the past few months and has maintained an accommodative stance as well.

Terminating a project and pulling out of RCEP

Two developments in November adversely affected India’s perception among international investors. On November 12, the Andhra Pradesh government terminated a project to develop the state’s new capital city in Amaravati. The termination of the project meant that a contract the previous government in the state had signed with a consortium of Singaporean companies also stood cancelled. The violation of a contract entered into by a sovereign entity is likely to have an adverse impact on India’s reputation as a destination for foreign investment.

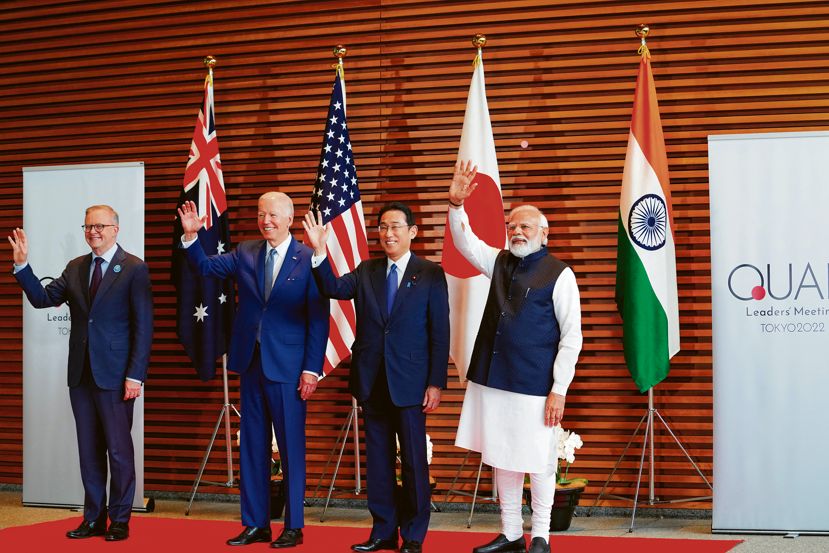

Similarly, India pulled out of the negotiations for concluding the world’s largest trading arrangement – Regional Comprehensive Economic Partnership (RCEP) among 10 member-countries of the ASEAN and six other countries including China, Japan, South Korea, Australia, New Zealand and India. India had been negotiating the terms for the treaty for the last seven years, but pulled out of it on the ground that it did not get a fair deal in addressing its concerns over surge in imports, particularly from China. India’s move to pull out of RCEP was abrupt and once again underlined the need for introducing deep manufacturing sector reforms to make the Indian industry and economy ready to face competition and improve productivity as well as efficiency. Without such reforms, India faces the danger of further raising the walls of protectionism around it.