HIGHLIGHTS

- Finance ministry bets on rural demand recovery

- Mixed signals from Govt finances in April-June 2022

- Inflation remains elevated, though on a decelerating path

- No escape for RBI from presenting inflation report to Govt

- Industrial growth up but marginally above pre-Covid days

- Exports growth slows; annual increase could be just 14 per cent

- No respite from further tightening of monetary policy

- Digital payment and lending norms in for overhaul

- Electricity law change triggers protests; sent to Parliament panel

- Ban on using power spot market shows stress in the sector

- PM sets five goals for India to be a developed nation by 2047

Finance ministry bets on rural demand recovery

How does the government look at the state of the Indian economy? An indication is available from the latest monthly economic report, released by the Union finance ministry. Far from being worried as it was in an earlier report, where it highlighted the dangers of a twin deficit looming large before the economy, the July report is a little more optimistic, pinning its hopes on the revival of rural demand. It noted that rural demand was set to recover as inflation was set to come down and the south-west monsoon proved supportive to the sowing season. “Kharif sowing supported by the south-west monsoon, coupled with a higher minimum support price for kharif crops, is likely to enhance rural demand. Urban consumption is expected to benefit from the demand for contact-intensive services, improving performance of corporates and growing optimism of consumers,” the report noted. The finance ministry report also pointed out that the financial and corporate sectors had shown resilience and the services sector had recovered to boost growth, even as the geopolitical environment remained tense and recessionary fears in advanced economies were troubling. But as far as the broad Indian economy was concerned, Finance Minister Nirmala Sitharaman sounded a note of optimism, ruling out recession or stagflation in the domestic economy.

Mixed signals from Govt finances in April-June 2022

The Union government’s finances in the first quarter of 2022-23 highlight both recovery and a few challenges. Consider the signs of recovery. The Centre’s gross tax collections in April-June 2022 rose by 22 per cent to Rs 6.5 lakh crore. This increase is way above the annual growth target of about 1.8 per cent. The net tax collections (which account for transfer to the states) also rose by 23 per cent to Rs 5.06 lakh crore, against an annual growth target of 6.31 per cent. Of course, the first quarter of 2021-22 was reeling under the impact of the second wave of Covid-19 and the performance in 2022-23 benefited from the low-base effect. Nevertheless, the increase was substantial. Non-debt capital receipts saw a huge jump of over 300 per cent to Rs 28,000 crore, riding primarily on the proceeds from the initial public offer of Life Insurance Corporation. Expenditure growth, however, exceeded the targets. Revenue expenditure growth in the first quarter of 2022-23 was 9 per cent, while the Budget had projected a marginal contraction of about 0.2 per cent. Capital expenditure too rose by 58 per cent to Rs 1.75 lakh crore, much more than the annual growth target of 26 per cent. The fiscal deficit was a little off the target but appeared to be under control in the first quarter. The first three months saw the deficit account for about 21 per cent of the full year’s target, a little higher than the 18 per cent reached in the same period of 2021-22. Non-tax revenues saw their collections fall by 52 per cent, largely because of lower dividends from the Reserve Bank of India. But this is not a real concern. The annual target of non-tax revenue is Rs 2.69 lakh crore, compared to Rs 3.48 lakh crore in 2021-22. Hence, the April-June 2022 performance should catch up soon with the annual target. The real challenges would be on account of the excise duty collections, where the duty was cut for petrol and diesel, higher fertiliser subsidy burden and the extra expenditure on account of various schemes like the free food ration scheme. While some benefits would accrue through the levy of windfall taxes and the benefit of lower costs on account of reduced food grain procurement this year, it is still not clear if the fiscal deficit target of 6.4 per cent of GDP can be achieved. The government is confident that it would achieve that goal. An indication would be available when the government releases its borrowing programme for the second half of the current year.

Inflation remains elevated, though on a decelerating path

Early signs of cooling inflation provided some comfort to policy makers in New Delhi. Retail inflation, measured by the movement in the Consumer Price Index, as marginally lower at 6.71 per cent in July, compared to 7.01 per cent in the previous month. July was the first month in the current financial year that retail inflation was below the 7 per cent mark. Retail food inflation stayed above 6.75 per cent in July, down significantly from 7.75 per cent in June. The rise in wholesale prices also slowed considerably. The Wholesale Price Index showed an inflation rate of 13.93 per cent in July, compared to 15.18 per cent in June and much below the record high level of 16.63 per cent recorded in May 2022. On a yearly basis, WPI-based inflation in July 2022 was higher than 11.57 per cent in the same month of 2021. The July number was a little lower than in the past few months because of easing of vegetable, milk and fuel prices. However, it remained in double digits for the sixteenth consecutive month. Since WPI-based inflation accounts for 65 per cent of deflator (the other 35 per cent is derived from retail inflation) for calculating the nominal gross domestic product, the nominal size of the economy would remain elevated, providing some comfort to the government’s deficit numbers.

No escape for RBI from presenting inflation report to Govt

The higher inflation number was no relief for the Reserve Bank of India, which according to its inflation mandate had to keep the inflation rate at 4 per cent, with an upper tolerance band of 6 per cent. With the RBI’s inflation forecast showing that retail inflation would stay above 6 per cent for the next two months, it is now certain that the monetary policy committee of the central bank would meet in October to decide on what it should say in its report to the finance ministry on its assessment of the inflation situation and what steps it would take to bring it below the upper tolerance band of 6 per cent. The law mandates that if retail inflation stays above the upper tolerance band of 6 per cent for three consecutive quarters, the RBI would have to submit a report on inflation assessment and remedial measures to the finance ministry. The report of the RBI to the finance ministry would be a public document, which is likely to be tabled in Parliament as well. The document would be closely examined by market participants and experts to understand the monetary policy approach of the RBI in the months to come.

Industrial growth up but marginally above pre-Covid days

Industrial growth in June 2022 was reported at 12.3 per cent, a little lower than 13.8 per cent recorded in the same month of 2021. It was lower than 19.6 per cent growth recorded in May 2022. Manufacturing, which has a weight of over 77 per cent in the Index of Industrial Production, rose by 12.5 per cent in June, compared to 13.2 per cent in the same month of 2021. Capital goods also maintained robust growth at 26 per cent, but consumer non-durables (mainly fast-moving consumer goods) reported tepid growth of about 3 per cent, while consumer durables did well at 24 per cent. Interestingly, the first quarter of 2022-23 showed an industrial growth rate of 12.7 per cent, compared to 44 per cent in the same quarter of 2021-22. The deceleration is because the first quarter of last year benefited from a low-base effect. The April-June 2022 industrial growth, when compared with the performance in April-June 2019-20 period (a pre-Covid period), is only 4.8 per cent. Industrial output therefore has inched up beyond the pre-Covid period, but the growth rates are obviously a little exaggerated because of the Covid-led devastation in the first quarter of 2020-21 and the smart statistical recovery of the same period of 2021-22.

Exports growth slows; annual increase could be just 14 per cent

Merchandise goods exports in July grew at a slower pace. Exports, estimated at $36.27 billion, were only 2 per cent higher than in the same month of 2021. Worryingly, the tepid growth was due to contraction in exports from India’s key sectors like engineering goods, gems, jewellery, pharmaceuticals, readymade garments and cotton yarn. However, imports in July were estimated at $66.27 billion, showing robust growth of 43.61 per cent, riding on petroleum products, coal and electronic goods, whose imports value rose as a result of higher prices. Gold imports fell by 43 per cent to $2.37 billion, in response to higher import duty that the government had imposed on gold imports. On a cumulative basis, India’s exports growth in April-July 2022 was 20 per cent at $157.44 billion, while imports growth was 48 per cent at $256.43 billion. India’s merchandise goods trade deficit in these four months widened by 135 per cent to $99 billion. Questions are arising over India’s exports performance in the current year. The government expects that exports during 2022-23 would still be about $470-480 billion, 12-14 per cent over the performance in 2021-22. The worry is on the imports front. If imports continue to grow at the same pace, it will start exerting pressure on the country’s external account.

No respite from further tightening of monetary policy

The Reserve Bank of India continued its hawkish fight against inflation, as evident from the outcome of the deliberations by its six-member Monetary Policy Committee held from August 3 to 5. The Committee decided to raise the policy repo rate (at which banks can borrow money from the Reserve Bank of India) by 50 basis points to 5.4 per cent – a three-year high and higher than the pre-Covid rate of 5.15 per cent. With that rate hike, the central bank had raised the repo rate by 140 basis points in three instalments since May 2022. Clearly, the central bank was concerned over inflation and the rupee exchange rate in the wake of the global economic situation, the continuing Russia-Ukraine war and domestic inflation rate, which continued to hover at around 7 per cent. The Committee’s monetary policy stance also changed to focusing on withdrawal of accommodation, instead of the earlier approach of maintaining price stability along with growth. The hardening of the policy repo rate had an immediate impact on the home loan market, where major lenders planned to raise the rate to over 8 per cent. The bond market also responded with a rise in yield, although it softened a bit a few days later. With RBI Governor Shaktikanta Das clearly stating that the goal was to bring the inflation back to its target rate of 4 per cent, more rate hikes are expected in the next few monetary policy reviews. By the end of 2022, the policy repo rate could be about 5.75-6 per cent, according to some financial sector experts. The rate increase decision was taken in the backdrop of a range of developments: Continued growth in credit offtake (at 14 per cent in July 2022), marginal net inflow through foreign portfolio investments in debt and equity, rising tax collections and a rupee that depreciated by 4 per cent, which however was much lower than many other currencies.

Digital payment and lending norms in for overhaul

Two policy initiatives in the area of digital payments and lending were taken by the Reserve Bank of India in August. The first initiative was about laying down a regulatory framework for credit delivery through digital lending methods. There were many concerns over the quality, security and safety around the mushrooming growth in digital lending applications that were used to provide credit to customers. The share of non-bank financing companies in such lending through digital applications was rising, while the banking sector was reducing its exposure. In this backdrop, the RBI on August 10 issued guidelines to categorically specify that the digital lending business could only be carried out by entities regulated by the central bank or those permitted under the law. Among many things, the new guidelines made sure that the cost of digital loans in annual percentage rates needed to be disclosed to the borrower, automatic increase in credit limit without explicit consent of borrower was prohibited and data collected by digital lending applications should be need-based. The second initiative, made public on August 17, was to moot the idea of imposing a “tiered” charge on payments made through the Unified Payments Interface or UPI, based on different amount bands. At present, there are no charges on payments through UPI, an initiative that led to huge growth in digital payments in the country. Both the initiatives would impact the digital payments and lending activities in different ways and are expected to build strong and sustainable foundations for their growth.

Electricity law change triggers protests; sent to Parliament panel

The government took yet another big move towards reforming the electricity sector. But the move has triggered a controversy as many states, central trade unions, farmer bodies and opposition political parties are unhappy with many of its provisions. The provisions of the Electricity Amendment Bill envisaged far-reaching changes. They proposed that private companies would be allowed to enter the business of power distribution and consumers would be free to choose from a multiple set of service providers as it happens in the case of mobile phone services. The amendment bill sought to appropriately change Section 14 of the original law to permit usage of distribution networks by all licensees under provisions of non-discriminatory open access to enable competition, increase efficiency of distribution companies to ensure improved services. The amendment also sought to strengthen payment security mechanisms and give more powers to electricity regulators. The most important change in the electricity law pertained to the procedures for tariff fixation. It paved the way for a graded revision in tariff over a period of one year. The protests over the provisions of the amendment bill were the most vociferous from power sector employees. Farmers groups, led by the Samyukta Kisan Morcha and ten central trade unions held protests on August 9. The power ministry tried to assuage the protesting employees, farmers and central trade union representatives arguing that there were no changes in subsidy provisions and that the states were free to offer reliefs to the power distribution companies. However, the states continued to argue that their rights were being curbed through the amendment bill. In view of these protests, the government tabled the amendment bill, but immediately referred it to a parliamentary standing committee for further consultations. Days ahead would be tough for the government in bringing round the power workers, farmers and state governments to see merit in the proposed reforms for the power distribution system.

Ban on using power spot market shows stress in the sector

India’s power sector was in the news in August for a variety of reasons. There was the legislative bill to amend the Electricity Act to allow private companies provide last-mile power services to households by using the open access policy. There were also reports that suggested how India’s power distribution companies were burdened with outstanding dues of over Rs 2.5 lakh crore. While the government was trying to offer yet another scheme to help the distribution companies reduce their payment liabilities with participation of the state governments, fresh data revealed how the Power Finance Corporation had become the single largest supplier of credit to the power sector, racing ahead of the commercial banks. While this was a relief for the banks, as they were getting out of a sector where payment problems were not getting resolved, the financial prospects of the Power Finance Corporation looked a little gloomy. If the Power Finance Corporation becomes burdened with loan repayment dues, it would be the proverbial case of the doctor getting sick instead of curing the patient. The situation got worse on August 18, when the Power System Operation Corporation or POSOCO, which is the national grid operator under the power ministry, debarred as many as 12 states and a union territory from buying or selling electricity at the spot market as a penalty for not clearing their dues to power generating companies. This was the first time that POSOCO had invoked the rules to penalise distribution companies and the states by disallowing them to purchase electricity from alternative short-term sources like the spot market. The power distribution companies, debarred from accessing the spot market, are from states like Telangana, Tamil Nadu, Rajasthan, Jammu & Kashmir, Andhra Pradesh, Maharashtra, Karnataka, Madhya Pradesh, Jharkhand, Bihar, Manipur, Chhattisgarh and Mizoram. The cumulative amount owed by the defaulting distribution companies from these states to the generating companies is estimated at Rs 5,083 crore.

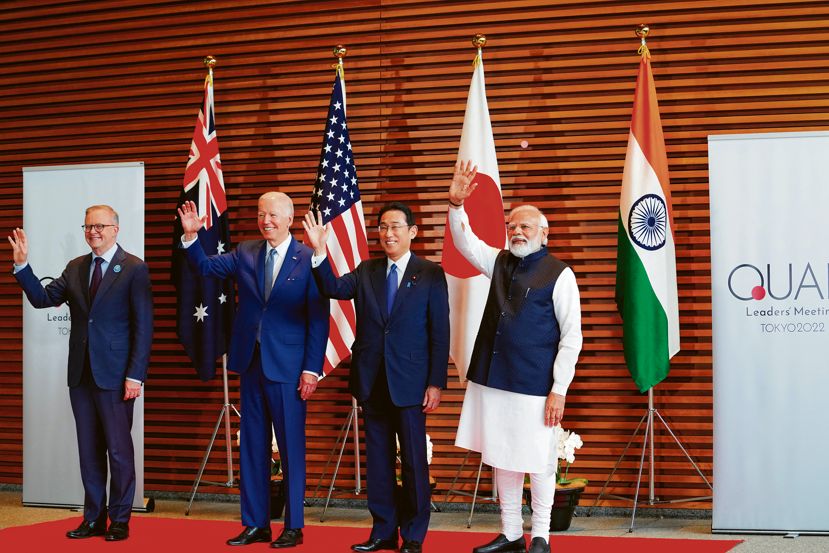

PM sets five goals for India to be a developed nation by 2047

Prime Minister Narendra Modi’s address to the nation from the ramparts of Red Fort on August 15 was as remarkable for the absence of any announcement for new schemes as for the five-point goal that he set for the nation to be achieved in the next 25 years. These five goals were all aimed at making India a developed nation by 2047, he said. These were: Moving forward with bigger resolves to develop India, erasing all traces of servitude, taking pride in the country’s legacy, focusing on India’s strength of unity and fulfilling the duties of a citizen with honesty. The prime minister also exhorted the states to compete among themselves in a healthy manner to expedite development. There was a pledge from the prime minister to give a bigger push to woman power in different spheres of the economy. He called for innovation in defence products and energy sector by pursuing the principles of self-reliance or Atmanirbharata. The prime minister’s address triggered a healthy debate in the country. Experts noted how difficult it would be for India to become a developed country in the next 25 years, given its current level of per capita income and the challenges ahead. A boost to women power was needed, but the current low women participation in the labour market of less than 20 per cent was a reminder of the enormity of the challenge ahead.

The previous issues of Indian Economy Review are available here: LINK

Supported by

………………………………………………………………………………………………

(The views expressed are personal)

………………………………………………………………………………………………